Fundamental vs Technical Analysis In-Depth Comparison

Others use price patterns, and complex analysis frameworks like Elliott Waves and Market Profile. Trend followers use other tools to identify price trends and measure momentum. Fundamental and technical analysis are two major schools of thought when it comes to approaching the markets, yet are at opposite ends of the spectrum. Investors and traders use both to research and forecast future stock prices. Like any investment strategy or philosophy, both have advocates and adversaries. There is a wide range of technical indicators, all of which show fluctuating values based on calculations of historical prices.

- However, for long term investors, it’s important to have an idea of the value of a company.

- And, new technologies like artificial intelligence and big data can also enhance all three forms of analysis.

- Like any investment strategy or philosophy, both have advocates and adversaries.

- If you don’t know what technical analysis is, be sure to read my previous post about what technical analysis is.

- A significant difference between both is the lifetime of shareholding.

- Quantitative analysis is a technique which uses mathematics to produce statistical analysis to reduce an outlook to a numerical value.

For example, a trader may be eyeing a breakout near an earnings report and look at the fundamentals to get an idea of whether the stock is likely to beat earnings. Simple moving averages are indicators that help assess the stock’s trend by averaging the daily price over a fixed time period. Buy and sell signals are generated when a shorter duration moving average crosses a longer duration one. Fundamental analysis and technical analysis are the major schools of thought when it comes to approaching the markets.

Quality Management

The objective is not to predict the future, but to identify the most likely scenarios. Price action is used as an indication of how market participants have acted in the past and how they may act in the future. Although a stock’s value is ultimately an opinion, relatively undervalued companies can outperform over the long term.

Short term price movements and volatility cannot be forecast by looking at financial statements. Valuation models like the discounted cash flow model are based on numerous assumptions which are seldom very accurate. Target valuations can be useful on a relative basis but are limited when it comes to valuing a company more than one or two years into the future.

All Essentials: Financial Literacy

In other words, technical analysis can be defined as a method used to determine the upcoming price of securities based on charts to identify trends and patterns. Technical analysis is relevant for investments that are held for a shorter time. Technical analysis only considers the previous data and is useful solely for trading functions. Thus, the technical analysis aims to identify the perfect time for entering or exiting the market. Fundamental analysis is useful for long-term investments, while technical analysis is for short-term investments.

People can gain the essential skills to achieve good ROI through our Financial Analysis of stocks course and Technical analysis training online. The price at which the buyer and seller of the share, decides to settle the deal, is one such value which combines, weighs and expresses all the factors, and is the only value which matters. In other words, technical analysis gives you a clear and comprehensive view of the reason for changes in prices of a security. It is based on the premise that the price of share move in trends, i.e. upward or downward, relying upon the attitude, psychology and emotion of the traders. Fundamental analysis is typically most indicative of a major price change when it unexpectedly reverses a trend.

Tools used for fundamental and technical analysis

Some feel that technical analysis has been discredited, or at least has a bad name. This is because too many traders go crazy using indicators and get overly concerned with which indicators and settings they use. Fundamental analysis tells you very little about what might happen in the short term.

Commodities vs Stocks: Top 5 Differences & Trading Tips – DailyFX

Commodities vs Stocks: Top 5 Differences & Trading Tips.

Posted: Tue, 15 Nov 2022 20:05:46 GMT [source]

In A Random Walk Down Wall Street, author Burton G. Malkiel exemplifies this thinking by detailing how an investor is better at guessing than stock picking. Fundamentally focused investors often wait a long time before a company’s intrinsic value is reflected in the market, if at all. For example, value investors often assume that the market is mispricing a security over the short term, but also assume that the price of the stock will correct itself over the long run. This “long run” can represent a time frame as long as several years in some cases. Fundamental analysis evaluates stocks by attempting to measure their intrinsic value.

The fundamental analysis enables analysts to forecast future performance by using an organization’s financial reports. In contrast, technical analysis enables analysts to ascertain whether previous patterns in stock prices will repeat in the coming time. Fundamental analysis considers both previous and current data, whereas technical analysis considers only past data. By analyzing these factors, fundamental analysts aim to determine whether a company or asset is overvalued or undervalued by the market.

Key Factors To Check Before Buying A Stock

It can be used to analyze stocks, derivatives, futures, options, and currencies. The most effective elements of fundamental analysis in trading Forex are central bank monetary policies, especially interest rates, and inflation. As the Forex market is driven mainly by the US Dollar which accounts for something like 80% of Forex globally, FOMC meetings are usually the most important fundamental event in the Forex calendar to watch. The weekly candlestick at the time of the Fed’s announcement hovered around the key 95.00 psychological round number along with the bull pennant’s (marked in yellow) lower support line and the 50-day SMA. These technical indicators were beginning to hint at a forthcoming bullish price movement. From this point, a trader could wait for the weekly candlestick to close (shaded in blue) which provided an additional bullish signal by the lower long wick of the candlestick.

For example, anyone with minimal chart-reading experience can look at a price chart and tell whether the price has gone up over the past six months, and whether it has done so strongly or weakly. Getting a good handle on the interplay between economic data points and central bank policies as data over or undershoots is much more complicated. Technical analysis studies previous patterns, charts, and trends to make predictions concerning an organization’s future price movements.

Long-term & Short-term Price Movement in Fundamental and Technical Analysis

Focusing only on the business, rather than on the stock price, gives investors an idea of what the company is actually worth. Investing during market bubbles can be rewarding – but it’s still important to know when the market is in a bubble. Fundamental analysis focuses on a security’s past and present performance and determines its future price. Technical analysis, on the other hand, relies on price momentum (measured differentiate between fundamental and technical forecasting by trading charts and indicators) to determine future prices. Technical analysis and fundamental analysis are often seen as opposing approaches to analyzing securities, but some investors have experienced success by combining the two techniques. For example, an investor may use fundamental analysis to identify an undervalued stock and use technical analysis to find a specific entry and exit point for the position.

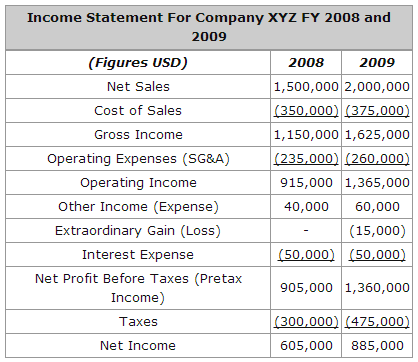

Fundamental analysis is ideal for long-term investments, while technical analysis is suited for short-term trading. Both approaches offer valuable insights and can be used together to make better investment decisions. In fundamental analysis, the intrinsic value of a stock can be determined by analyzing the income and cash flow statement, balance sheet, return on equity, profit margin, price-earnings ratio, and so on.

Differences between Fundamental Analysis and Technical Analysis

A good way to conceptualize the difference is to compare it to someone buying a home to flip versus someone who’s buying a home to live in for several years. Adam Lemon began his role at DailyForex in 2013 when he was brought in as an in-house Chief Analyst. He has previously worked within financial markets over a 12-year period, including 6 years with Merrill Lynch. Proponents of either form of analysis often write the alternative off but misunderstand that they can both have their place. Fundamental analysis is most useful for long term investments, while technical analysis is more useful for short term trading and market timing.

- The biggest profits are usually made by the investors that are correct when the rest of the market is wrong.

- When trading shares, fundamental analysis can be applied to evaluate certain factors such as the performance of a company, news and environmental conditions.

- There are a number of momentum-based indicators, such as Bollinger Bands®, Chaikin Money Flow, stochastics, and moving average convergence/divergence (MACD).

- Fundamental analysis is most useful for long term investments, while technical analysis is more useful for short term trading and market timing.

In the short term, price action is affected by several factors that fundamental analysis cannot pick up. The effects of market sentiment, market psychology, and supply and demand can all be observed by looking at a chart. Technical analysis can be used to improve timing, and to trade strategies appropriate to market conditions. The fundamental technique analyses financial statements, forecasts, management quality and the earnings and growth trends. They then make judgements related to the pricing based on subjective opinions from the available information and statistics.

SABILA BOUTIQUE HOTEL